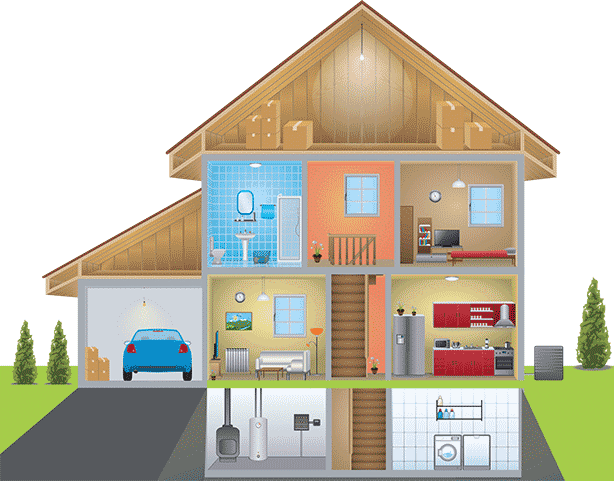

Improve Your Home’s Efficiency

Photo Source: Windfall Home Energy Solutions

- Replace old and drafty windows and doors with new, more efficient models.

- Replace old appliances with new, Energy-Star rated appliances.

- Upgrade your insulation or have your attic, basement or crawl space spray foamed for improved heat retention.

- Replace old shingles to increase the performance of your home’s envelope.

- Replace incandescent bulbs with compact fluorescent bulbs.

Seasonal Maintenance

Fall Renovations To-do List includes basic maintenance tasks completed before winter can go a long way towards an enjoyable and stress-free winter in your home!

Fall Renovations To-do List includes basic maintenance tasks completed before winter can go a long way towards an enjoyable and stress-free winter in your home!

- Furnace and heating system inspections should be completed now to ensure you have no heating problems this winter. This may include changing air filters, replacing an old furnace, cleaning out a boiler system or the like.

- If you have a wood-burning fireplace, have the chimney cleaned or consider replacing it with a gas insert that will reduce maintenance and improve performance.

- Check your roof for any issues that might cause leaking, clean out gutters and consider installing a heating cable to prevent snow and ice build-up from damaging your roof over the winter.

- If you live in an area that is prone to winter storms, make sure you are prepared by creating an emergency kit, installing a generator as a backup power source, trimming back dead tree limbs that might fall and damage your home in a storm and ensuring winter equipment like your snow blower are in working condition

Creating Cozy Spaces

Photo Source: HomeSense Fall Look Book

- Finishing renovation projects started over the summer.

- Replacing old, outdated furniture with newer, more comfortable pieces.

- Replace a wood-burning fireplace with a modern gas insert that offers better performance and lower maintenance.

- Finishing an unfinished basement to add more usable living space to your home.

Preparing for Holiday Guests

Photo Source: sheknows.com

- Updating your kitchen to make entertaining easier.

- Add or update a guest bedroom for overnight guests.

- Give the main areas in your home a new look with a fresh coat of paint.

- Repair or replace broken or damaged fixtures, cabinetry, doors, flooring, etc.

The following two tabs change content below.

Tribecca Finance is an alternative lending solution for many people in Ontario. We are dedicated to treating all of our customers as more than just a number. Our customers always receive personal service from one of our professional and friendly lending specialists. We understand that life is full of financial challenges and opportunities. We listen and work with you to offer loan solutions to meet your needs. Our lending products consist of personal loans, home equity loans, construction loans, first mortgages and second mortgages.

Latest posts by Tribecca (see all)

- Weekend Home Decor Updates - July 14, 2025

- Fall Renovations To-do List - July 14, 2025

- College Living Arrangements Options - July 14, 2025

I really need to replace my old appliances with new, Energy-Star rated appliances.Thanks for the great article!

Great help with fall projects